H/T Matt Yglesias

Wednesday, January 16, 2013

We Have To Level With You: Poor People Make $180k A Year. Also, They're Probably Brown.

At least those are the lessons from this Wall Street Journal infographic (which we ADORE). Truly, how better to grapple with with the disparate impact of the fiscal cliff deal than by pondering a world where families earn just 14 times the median household income, while single mothers scrape by with a skint $260,000 in their pocket. The chubby-cheeked rascals!

H/T Matt Yglesias

H/T Matt Yglesias

Friday, April 13, 2012

You Like Apple? How 'Bout Them Apples

So I had a funny day yesterday.

I arrived at work sharpish, with my four-shot venti mocha in hand. The sun was shining, it was a balmy 85 degrees, and I was called out to spend the morning reviewing an event plan for the grand opening of a new branch.

As we were doing the walkthrough, my VP and another coworker got into a heated discussion about the placement of the registration tent. “Have no fear!” I said in a happily caffeinated voice. “Allow me to demonstrate, visually, our options for tent placement.”

But what to use as a prop? I’d need something sort of squarish. Something that I could hold in my hands and maneuver in such a way as to indicate the possible orientations of a large tent. But what’s this! It’s a work-issued, $600 iPad 2! This would be perfect! And certainly with my long track record of not being physically awkward in any way, shape, or form, nothing bad could come of this!

“Ok,” I said, “first, we could keep the tent angled away from traffic flow, like s . . .”

SCHTHWAK.

SCHTHWAK? you ask. What an odd sound. What possibly could make such a peculiar noise? Allow me to enlighten you. SCHTHWAK is the sound that a work-issued, $600 iPad makes when it flips out of your hands and lands, with almost Herculean force, ten inches from your Vice President of Marketing and Sales feet.

“Interesting,” I commented.

“Why did we hire you, again?” she replied.

In related news, it turns out that this sort of thing is not covered by Apple’s ridiculously short-sighted and stingy warranty policy.

“That’s terrible,” you’re all no doubt thinking, nodding amongst yourselves. “But at least even Scott’s LEGENDARY inability to properly operate the fingers on his hands couldn’t lead to any more mishaps today. Job done.”

Hahahah, I can only reply. Hahahahahahahahahhahahahahahhah.

So I go for a nice, relaxing walk on the treadmill at the gym. Not even a run! Just amblin’ along at a lazy Southern pace. And my mom calls! Can’t not answer a phone call from your mother, can you guys? So I pick up my nearly new, affectionately protected, much loved iPhone 4. So we have a nice chat. Yes mom! Broke the iPad! Just like that! After ten days! What do you mean, you can’t decide whether you’re more disappointed or unsurprised? I hardly think that’s constructive. No, I don’t think you should be more proud of my sister. Tell you what, I’m going to go for a run. Yes. I’ll call you ba . . .

SCHTHWICK.

And now you say, Well, that sound is both familiar and oddly different. Indeed it is! It turns out that an uninsured iPhone 4 makes a slightly different noise when it slips out of your hand boomerang style, spins across the rooms, and nearly beheads a very surprised looking lady currently riding the elliptical machine two feet to your right.

“Interesting,” I commented.

“Wow,” she said. “You took that really well.”

“Yeah,” I replied. “Well, I’ve sort of had practice.”

So there you go. Ten hours, two Apple devices, and over $1000 in un-warrantied damages. Sometimes I even amaze myself.

I arrived at work sharpish, with my four-shot venti mocha in hand. The sun was shining, it was a balmy 85 degrees, and I was called out to spend the morning reviewing an event plan for the grand opening of a new branch.

As we were doing the walkthrough, my VP and another coworker got into a heated discussion about the placement of the registration tent. “Have no fear!” I said in a happily caffeinated voice. “Allow me to demonstrate, visually, our options for tent placement.”

But what to use as a prop? I’d need something sort of squarish. Something that I could hold in my hands and maneuver in such a way as to indicate the possible orientations of a large tent. But what’s this! It’s a work-issued, $600 iPad 2! This would be perfect! And certainly with my long track record of not being physically awkward in any way, shape, or form, nothing bad could come of this!

“Ok,” I said, “first, we could keep the tent angled away from traffic flow, like s . . .”

SCHTHWAK.

SCHTHWAK? you ask. What an odd sound. What possibly could make such a peculiar noise? Allow me to enlighten you. SCHTHWAK is the sound that a work-issued, $600 iPad makes when it flips out of your hands and lands, with almost Herculean force, ten inches from your Vice President of Marketing and Sales feet.

“Interesting,” I commented.

“Why did we hire you, again?” she replied.

In related news, it turns out that this sort of thing is not covered by Apple’s ridiculously short-sighted and stingy warranty policy.

“That’s terrible,” you’re all no doubt thinking, nodding amongst yourselves. “But at least even Scott’s LEGENDARY inability to properly operate the fingers on his hands couldn’t lead to any more mishaps today. Job done.”

Hahahah, I can only reply. Hahahahahahahahahhahahahahahhah.

So I go for a nice, relaxing walk on the treadmill at the gym. Not even a run! Just amblin’ along at a lazy Southern pace. And my mom calls! Can’t not answer a phone call from your mother, can you guys? So I pick up my nearly new, affectionately protected, much loved iPhone 4. So we have a nice chat. Yes mom! Broke the iPad! Just like that! After ten days! What do you mean, you can’t decide whether you’re more disappointed or unsurprised? I hardly think that’s constructive. No, I don’t think you should be more proud of my sister. Tell you what, I’m going to go for a run. Yes. I’ll call you ba . . .

SCHTHWICK.

And now you say, Well, that sound is both familiar and oddly different. Indeed it is! It turns out that an uninsured iPhone 4 makes a slightly different noise when it slips out of your hand boomerang style, spins across the rooms, and nearly beheads a very surprised looking lady currently riding the elliptical machine two feet to your right.

“Interesting,” I commented.

“Wow,” she said. “You took that really well.”

“Yeah,” I replied. “Well, I’ve sort of had practice.”

So there you go. Ten hours, two Apple devices, and over $1000 in un-warrantied damages. Sometimes I even amaze myself.

Tuesday, August 16, 2011

The Texas Miracle, Or, It's The Denominator, Stupid

Advance apologies to my nice and numerous fellows in Texas - but this had to be said.

As Rick Perry barges helter-skelter into the Republican primaries, pundits everywhere are reflecting on the unusual durability of the Texan job market. Texas, they are quick to say, has created 40% of the nation's jobs since the start of the recession.

This brings me to a larger point that's not quite related to our usually superbly enjoyable partisan bashing. As the title of this post says, it's the denominator, stupid. Or rather, the jobs created are only half of the story.

Let me put it this way: Privately, I suggest that the single most common logical mistake made by the average person is confusing real and nominal values. They think that their home represents vast earning, when it's barely paced inflation. They think that prices are rising out of control when the real price level barely budges.

But perhaps the second most irritating, irrational error is to think that a numerator matters alone, when it only matters in context. It's not Texas' employment that's important. It's Texas' employment to population ratio.

And Texas' population has been expanding rapidly. So yes, Texas has created 40% of the nation's post recession jobs - but it's unemployment ratio is as high as New York's. Yes, Texas has created 40% of the nation's post recession jobs - but the percent of it's population employed is actually falling. Yes, Texas has created 40% of the nation's post recession jobs - but only through similarly massive immigration.

This isn't to nitpick on Texas. Rather, it's to point out that so far Texas has succeeded in creating enough jobs to barely pace it's population growth while keeping it's unemployment rate around about the national average. That's fine, but it doesn't count as a unique victory.

And as Krugman rightly points out, even that model doesn't help much. People can move from everywhere else to Texas, but they can't move from everywhere, to everywhere, all at once. Unless Rick Perry is arguing for open borders and higher immigration. Something tells me to doubt it.

As Rick Perry barges helter-skelter into the Republican primaries, pundits everywhere are reflecting on the unusual durability of the Texan job market. Texas, they are quick to say, has created 40% of the nation's jobs since the start of the recession.

This brings me to a larger point that's not quite related to our usually superbly enjoyable partisan bashing. As the title of this post says, it's the denominator, stupid. Or rather, the jobs created are only half of the story.

Let me put it this way: Privately, I suggest that the single most common logical mistake made by the average person is confusing real and nominal values. They think that their home represents vast earning, when it's barely paced inflation. They think that prices are rising out of control when the real price level barely budges.

But perhaps the second most irritating, irrational error is to think that a numerator matters alone, when it only matters in context. It's not Texas' employment that's important. It's Texas' employment to population ratio.

And Texas' population has been expanding rapidly. So yes, Texas has created 40% of the nation's post recession jobs - but it's unemployment ratio is as high as New York's. Yes, Texas has created 40% of the nation's post recession jobs - but the percent of it's population employed is actually falling. Yes, Texas has created 40% of the nation's post recession jobs - but only through similarly massive immigration.

This isn't to nitpick on Texas. Rather, it's to point out that so far Texas has succeeded in creating enough jobs to barely pace it's population growth while keeping it's unemployment rate around about the national average. That's fine, but it doesn't count as a unique victory.

And as Krugman rightly points out, even that model doesn't help much. People can move from everywhere else to Texas, but they can't move from everywhere, to everywhere, all at once. Unless Rick Perry is arguing for open borders and higher immigration. Something tells me to doubt it.

Wednesday, July 20, 2011

Schwaa?

Things like this get our blood a-boilin':

Even the most inveterate Kenyan-colonial socialists among us admit that privatising the GSEs was, in retrospect, a pretty significant fuck up. They were pro-cyclical entities backed with a government guarantee, and that's never going to be stabilizing. But that's a contributing, not a causual, factor. They did not cause the crisis; they enabled the other actors in the crisis through a combination of market making and liquidity.

Hating the GSEs is a lot of fun, but saying, "Lookee, it's all their fault" involves ignoring pretty much the entire behaviour of the private-label mortgage originators during the crisis, or the fate of their loan portfolios (yes, compared directly to Fannie and Freddie) after the crisis. The GSEs subprime originations look pretty damn terrible - PLS subprime portfolio performance looks like a goddamn catastrophe.

What we have here are two sets of people talking past each other. One set says, "The GSEs caused the crisis." The other replies, "No, they didn't, because they didn't start the subprime movement, they lost significant market share during the bubble, and even their eventual subprime market offerings fared better than PLS paper. But yeah, they were a pretty terrible idea." And then the other replies, "The GSEs were a terrible idea, why can't you just admit that?" And then the other replies back, "We just did, and what the fuck happened to your original question?"

Really, it just gives us a headache.

We had these big interconnected undercapitalized things that were mandated by federal policy to keep expanding the amount of paper they bought or backed, which meant inevitably they were going to reach the point where the paper they were backing was too risky, and the GSE’s mandated growth necessarily called for them to issue more paper of their own to do that..And then you had Basel II and its US application that made GSE paper Tier I capital to support maximum loan growth in private sector banks. No wonder credit dried up when the GSEs were taken over in Sept 08. But you never see the Rortys and Mins speak to this perspective.Damn. Thanks for beating the shit out of that strawman, esteemed commentator on Tyler Cowen's blog. Because I can't think of a serious leftwing economist who takes this position. Of course the GSEs where behemoth securitizing entities. Of course they provided liquidity in a market gripped by a bubble. Of course they were pro-cyclical. Of course they should be wound down. But that's not the argument. Because this whole thing kicked off with the question, "Did the GSEs cause the housing bubble?"

Even the most inveterate Kenyan-colonial socialists among us admit that privatising the GSEs was, in retrospect, a pretty significant fuck up. They were pro-cyclical entities backed with a government guarantee, and that's never going to be stabilizing. But that's a contributing, not a causual, factor. They did not cause the crisis; they enabled the other actors in the crisis through a combination of market making and liquidity.

Hating the GSEs is a lot of fun, but saying, "Lookee, it's all their fault" involves ignoring pretty much the entire behaviour of the private-label mortgage originators during the crisis, or the fate of their loan portfolios (yes, compared directly to Fannie and Freddie) after the crisis. The GSEs subprime originations look pretty damn terrible - PLS subprime portfolio performance looks like a goddamn catastrophe.

What we have here are two sets of people talking past each other. One set says, "The GSEs caused the crisis." The other replies, "No, they didn't, because they didn't start the subprime movement, they lost significant market share during the bubble, and even their eventual subprime market offerings fared better than PLS paper. But yeah, they were a pretty terrible idea." And then the other replies, "The GSEs were a terrible idea, why can't you just admit that?" And then the other replies back, "We just did, and what the fuck happened to your original question?"

Really, it just gives us a headache.

Thursday, June 16, 2011

In Which We Scratch Our Heads At Niall Ferguson

It's a well known fact that Niall Ferguson is in highly competitive race to become the Dumbest Man Alive. Whether it's his seminal Newsweek article "Please Obama, Talk More Harshly To The Egyptians, As Though They Could Give A Flying Fuck," or his deeply entertaining follow-up "The Real Problem With Obama Is That He Lacks The Delicate Political Touch Of Richard Nixon" Ferguson has been on a one-man quest to roll back the last shreds of his dignified reputation as a historian.

But these all pale in front of his latest effort, which ran in the June 6 Newsweek. In it, Ferguson excoriates Paul Krugman (the one with the Nobel Prize in economics) for focusing on how darn bad fiscal austerity has been for Ireland, Greece, Portugal, and now Britain.

Sure, Ferguson says. As these countries have cut budgets in the midst of a staggering recession, their economies have stagnated and fallen deeper behind. But no need to worry! Things are fucking cheesy in Switzerland, in spite of some modest budget cuts. So austerity is actually expansionary!

Let us dwell on that for a second.

Switzerland is an incredibly well-educated, export oriented economy that (surprise!) controls it's own currency. Personally, if I were in that situation, I would drive my interest rates to near zero and engage in a coordinated expansion of my monetary base. Plus, I'd let everyone know that since exports are FTW and my currency is a bit on the strong side, I'm planning on keeping them there for as long as I damn well felt like it. But I'm sure Switzerland has done nothing of the sort.

But of course, that's the whole point. Switzerland is nothing like the PIIGS. It's a one-off. More than that, it's not very much like us, either. So after trolling the world economies of 2008-2011, Ferguson has come up with one example where austerity has proven sort-of successful, and asked us to politely ignore Britain, Ireland, Greece, and Portugal.

What's really galling is that Ferguson plainly ignores the rest of Europe. If economics is such a morality tale, then why not look at Spain? Spain was the bees knees, budgetarily speaking. They had slashed their deficit and paid down their debts by half, but it sure didn't help them when the recession came calling. It's almost like the recession had nothing to do with deficits and everything to do with a worldwide collapse in aggregate demand precipitated by a financial crisis and exacerbated by household deleveraging. Funny, that.

So shorter Niall Ferguson: Ignore Britain, Spain, Ireland, Portugal, Italy, Greece, the counterexample of Iceland, the devaulation of the Canadian dollar in the 90s, the Japanese lost decade, and the effect of fiscal stimulus in China. It worked for Switzerland. Ferguson says so.

I have a headache.

But these all pale in front of his latest effort, which ran in the June 6 Newsweek. In it, Ferguson excoriates Paul Krugman (the one with the Nobel Prize in economics) for focusing on how darn bad fiscal austerity has been for Ireland, Greece, Portugal, and now Britain.

Sure, Ferguson says. As these countries have cut budgets in the midst of a staggering recession, their economies have stagnated and fallen deeper behind. But no need to worry! Things are fucking cheesy in Switzerland, in spite of some modest budget cuts. So austerity is actually expansionary!

Let us dwell on that for a second.

Switzerland is an incredibly well-educated, export oriented economy that (surprise!) controls it's own currency. Personally, if I were in that situation, I would drive my interest rates to near zero and engage in a coordinated expansion of my monetary base. Plus, I'd let everyone know that since exports are FTW and my currency is a bit on the strong side, I'm planning on keeping them there for as long as I damn well felt like it. But I'm sure Switzerland has done nothing of the sort.

But of course, that's the whole point. Switzerland is nothing like the PIIGS. It's a one-off. More than that, it's not very much like us, either. So after trolling the world economies of 2008-2011, Ferguson has come up with one example where austerity has proven sort-of successful, and asked us to politely ignore Britain, Ireland, Greece, and Portugal.

What's really galling is that Ferguson plainly ignores the rest of Europe. If economics is such a morality tale, then why not look at Spain? Spain was the bees knees, budgetarily speaking. They had slashed their deficit and paid down their debts by half, but it sure didn't help them when the recession came calling. It's almost like the recession had nothing to do with deficits and everything to do with a worldwide collapse in aggregate demand precipitated by a financial crisis and exacerbated by household deleveraging. Funny, that.

So shorter Niall Ferguson: Ignore Britain, Spain, Ireland, Portugal, Italy, Greece, the counterexample of Iceland, the devaulation of the Canadian dollar in the 90s, the Japanese lost decade, and the effect of fiscal stimulus in China. It worked for Switzerland. Ferguson says so.

I have a headache.

Friday, April 22, 2011

Moral Culpability And The Crisis: Our Least Sexy Title Ever

Ever since we experienced the highly enjoyable financial panic of 2008, people have been casting about for someone to blame. And why not? Every great crisis needs an equally great bad guy. It's fun, and it increases the chance that your abject misery will eventually get optioned into movie rights.

But there's one bad guy that's proving surprisingly popular: The homebuyers themselves. Why not? They were the irresponsible borrowers who took on too much debt, far too soon, and sent the economy into crisis. This is America, after all. If you have to hate someone, you might as well hate the common man.

We're probably behind the ball on this one, seeing as how the recession ended while we were suffering a particularly bad hangover during the entire month of June, 2009, so we should probably let this one go. But we're immodest fellows here at the Strawman Blogger, so late or not, we're going to put this myth to rest.

Don't worry. You can thank us later.

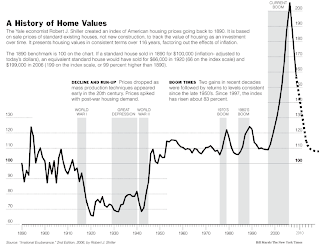

First, let's get a few things out of the way. Homeowners assumed too much debt in the crisis. That much is obvious:

And it also had very predictable consequences:

But participating in a crisis doesn't make you culpable for it. When you buy a home, you work with a team of people: Real estate agents who help you shop for a home, lenders who finance it, and industry experts who provide advice and perspective along the way. Each one earns money when you buy a home. And each one earns more money the more home you buy.

And, during the worst housing bubble in American history, each one argued that a bubble wasn't possible.

Realtors fed that delusion. In 2005, David Lereah, Chief Economist and Senior VP for the National Association of Realtors (NAR), argued that, "[t]here is virtually no risk of a national housing price bubble based on the fundamental demand for housing." In 2006, he predicted a "soft landing for the housing markets." Even as late as October, 2007, the NAR continued to peddle the line that, "[t]he speculative excesses have been removed from the market and home sales are returning to fundamentally health levels."

Nor were they alone. On August 18, 2007, celebrity columnist Ben Stein appeared on Cavuto on Business to state that, "[t]he credit crunch is way overblown ... The subprime problem is a problem, but it's a tiny problem in the context of this economy ... It's a buying opportunity, especially for the financials, maybe like I've never seen before in my entire life.

Financial firms were not immune to the excess. Abetted by the ratings agencies, which catastrophically failed to recognize the growing risks in the mortgage market, large investment banks were net long in housing until the bitter end. Even the previously responsible JPMorgan Chase, which had long avoided the collateralized debt obligation business, was eventually burned by the infamous Magnetar trade, losing $880 million on the Squared CDO alone.

But perhaps the most memorable remark came from then-Fed Chairman Alan Greenspan, who stated, "Although a 'bubble' in home prices for the nation as a whole does not appear likely, there do appear to be, at a minimum, signs of froth in some local markets ... Although we certainly cannot rule out home price declines, especially in some local markets, these declines, were they to occur, likely would not have substantial macroeconomic implications."

Homeowners took on too much debt. More than they could afford. But they didn't do it alone. They did it on the advice of their realtors, who assured them that housing was a good investment. They did it with loans from their banks, who were eager to finance mortgages in any way possible. They did so with liquidity provided by Wall Street, who's addiction to mortgage securitization fueled the crisis. And they did it on the advice and encouragement of financial experts and the Federal Reserve itself.

Each of these actors were experts in their own field. Should home buyers have ignored their advice? Perhaps. But arguing that means admitting that the entire mortgage industry was engaged in an exercise of bad faith - providing bad advice to good people, in hopes of turning a profit.

So who was at fault, you ask? Everyone. And no one. That's the trouble with bubbles. They work because they're so damn convincing. If no one believed in them, they wouldn't happen in the first place.

Well. That, and the bankers, of course.

But there's one bad guy that's proving surprisingly popular: The homebuyers themselves. Why not? They were the irresponsible borrowers who took on too much debt, far too soon, and sent the economy into crisis. This is America, after all. If you have to hate someone, you might as well hate the common man.

We're probably behind the ball on this one, seeing as how the recession ended while we were suffering a particularly bad hangover during the entire month of June, 2009, so we should probably let this one go. But we're immodest fellows here at the Strawman Blogger, so late or not, we're going to put this myth to rest.

Don't worry. You can thank us later.

First, let's get a few things out of the way. Homeowners assumed too much debt in the crisis. That much is obvious:

And it also had very predictable consequences:

But participating in a crisis doesn't make you culpable for it. When you buy a home, you work with a team of people: Real estate agents who help you shop for a home, lenders who finance it, and industry experts who provide advice and perspective along the way. Each one earns money when you buy a home. And each one earns more money the more home you buy.

And, during the worst housing bubble in American history, each one argued that a bubble wasn't possible.

Realtors fed that delusion. In 2005, David Lereah, Chief Economist and Senior VP for the National Association of Realtors (NAR), argued that, "[t]here is virtually no risk of a national housing price bubble based on the fundamental demand for housing." In 2006, he predicted a "soft landing for the housing markets." Even as late as October, 2007, the NAR continued to peddle the line that, "[t]he speculative excesses have been removed from the market and home sales are returning to fundamentally health levels."

Nor were they alone. On August 18, 2007, celebrity columnist Ben Stein appeared on Cavuto on Business to state that, "[t]he credit crunch is way overblown ... The subprime problem is a problem, but it's a tiny problem in the context of this economy ... It's a buying opportunity, especially for the financials, maybe like I've never seen before in my entire life.

Financial firms were not immune to the excess. Abetted by the ratings agencies, which catastrophically failed to recognize the growing risks in the mortgage market, large investment banks were net long in housing until the bitter end. Even the previously responsible JPMorgan Chase, which had long avoided the collateralized debt obligation business, was eventually burned by the infamous Magnetar trade, losing $880 million on the Squared CDO alone.

But perhaps the most memorable remark came from then-Fed Chairman Alan Greenspan, who stated, "Although a 'bubble' in home prices for the nation as a whole does not appear likely, there do appear to be, at a minimum, signs of froth in some local markets ... Although we certainly cannot rule out home price declines, especially in some local markets, these declines, were they to occur, likely would not have substantial macroeconomic implications."

Homeowners took on too much debt. More than they could afford. But they didn't do it alone. They did it on the advice of their realtors, who assured them that housing was a good investment. They did it with loans from their banks, who were eager to finance mortgages in any way possible. They did so with liquidity provided by Wall Street, who's addiction to mortgage securitization fueled the crisis. And they did it on the advice and encouragement of financial experts and the Federal Reserve itself.

Each of these actors were experts in their own field. Should home buyers have ignored their advice? Perhaps. But arguing that means admitting that the entire mortgage industry was engaged in an exercise of bad faith - providing bad advice to good people, in hopes of turning a profit.

So who was at fault, you ask? Everyone. And no one. That's the trouble with bubbles. They work because they're so damn convincing. If no one believed in them, they wouldn't happen in the first place.

Well. That, and the bankers, of course.

Labels:

debt,

financial crisis,

Great Recession,

greenspan,

jpmorgan,

realtors

Tuesday, April 19, 2011

We Could Do Something Stupider Than This, But We Wouldn't Want To Try

So even reasonable and adult Americans have lately been making sounds about refusing to raise the debt ceiling. Not at least without some smidgen of compromise, which will no doubt involve putting poor people in ankle shackles and driving them through the streets.

Honestly, this is so monumentally stupid that we actually be surprised, if we weren't such a cynical and worldly fellow. Let us be utterly clear on this point. Refusing to raise the debt ceiling doesn't change a single thing about our prolifigate, irresponsible, and altogether ill-considered spending. It just means that we refuse to pay the bills.

To put it another way: If the United States of America was you, refusing to raise the debt ceiling would be like refusing to pay your mortgage. I wonder how that would turn out?

Why is it that nominally intelligent people can't grasp this? If you want to do something about spending, cut spending. If you want to raise more in taxes, raise taxes. What you should NOT do, under any circumstances, is willingly default on the national debt simply because you want Medicare benefits issued in chickens.

This is not a bloody game. In 2008, led by a serious mispricing of extant market risk, the mortgage securities market suffered a massive panic and commisserate flight to safety, which crushed security prices and drove down Treasury yields. The inability of the market to supply a co-equal supply of new safe assets led to a collapse in aggregate demand that, along with global deleverging, threw the economy into a massive recession.

That's what happens when investors doubt the safety of MBSs and CDOs. Imagine what happens when the United States regularly, and for no reason other than it's simple bloodymindedness, starts defaulting on it's debt.

Honestly, this is so monumentally stupid that we actually be surprised, if we weren't such a cynical and worldly fellow. Let us be utterly clear on this point. Refusing to raise the debt ceiling doesn't change a single thing about our prolifigate, irresponsible, and altogether ill-considered spending. It just means that we refuse to pay the bills.

To put it another way: If the United States of America was you, refusing to raise the debt ceiling would be like refusing to pay your mortgage. I wonder how that would turn out?

Why is it that nominally intelligent people can't grasp this? If you want to do something about spending, cut spending. If you want to raise more in taxes, raise taxes. What you should NOT do, under any circumstances, is willingly default on the national debt simply because you want Medicare benefits issued in chickens.

This is not a bloody game. In 2008, led by a serious mispricing of extant market risk, the mortgage securities market suffered a massive panic and commisserate flight to safety, which crushed security prices and drove down Treasury yields. The inability of the market to supply a co-equal supply of new safe assets led to a collapse in aggregate demand that, along with global deleverging, threw the economy into a massive recession.

That's what happens when investors doubt the safety of MBSs and CDOs. Imagine what happens when the United States regularly, and for no reason other than it's simple bloodymindedness, starts defaulting on it's debt.

Subscribe to:

Comments (Atom)