Advance apologies to my nice and numerous fellows in Texas - but this had to be said.

As Rick Perry barges helter-skelter into the Republican primaries, pundits everywhere are reflecting on the unusual durability of the Texan job market. Texas, they are quick to say, has created 40% of the nation's jobs since the start of the recession.

This brings me to a larger point that's not quite related to our usually superbly enjoyable partisan bashing. As the title of this post says, it's the denominator, stupid. Or rather, the jobs created are only half of the story.

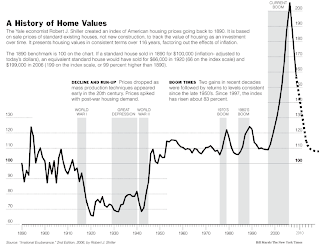

Let me put it this way: Privately, I suggest that the single most common logical mistake made by the average person is confusing real and nominal values. They think that their home represents vast earning, when it's barely paced inflation. They think that prices are rising out of control when the real price level barely budges.

But perhaps the second most irritating, irrational error is to think that a numerator matters alone, when it only matters in context. It's not Texas' employment that's important. It's Texas' employment to population ratio.

And Texas' population has been expanding rapidly. So yes, Texas has created 40% of the nation's post recession jobs - but it's unemployment ratio is as high as New York's. Yes, Texas has created 40% of the nation's post recession jobs - but the percent of it's population employed is actually falling. Yes, Texas has created 40% of the nation's post recession jobs - but only through similarly massive immigration.

This isn't to nitpick on Texas. Rather, it's to point out that so far Texas has succeeded in creating enough jobs to barely pace it's population growth while keeping it's unemployment rate around about the national average. That's fine, but it doesn't count as a unique victory.

And as Krugman rightly points out, even that model doesn't help much. People can move from everywhere else to Texas, but they can't move from everywhere, to everywhere, all at once. Unless Rick Perry is arguing for open borders and higher immigration. Something tells me to doubt it.

Tuesday, August 16, 2011

Wednesday, July 20, 2011

Schwaa?

Things like this get our blood a-boilin':

Even the most inveterate Kenyan-colonial socialists among us admit that privatising the GSEs was, in retrospect, a pretty significant fuck up. They were pro-cyclical entities backed with a government guarantee, and that's never going to be stabilizing. But that's a contributing, not a causual, factor. They did not cause the crisis; they enabled the other actors in the crisis through a combination of market making and liquidity.

Hating the GSEs is a lot of fun, but saying, "Lookee, it's all their fault" involves ignoring pretty much the entire behaviour of the private-label mortgage originators during the crisis, or the fate of their loan portfolios (yes, compared directly to Fannie and Freddie) after the crisis. The GSEs subprime originations look pretty damn terrible - PLS subprime portfolio performance looks like a goddamn catastrophe.

What we have here are two sets of people talking past each other. One set says, "The GSEs caused the crisis." The other replies, "No, they didn't, because they didn't start the subprime movement, they lost significant market share during the bubble, and even their eventual subprime market offerings fared better than PLS paper. But yeah, they were a pretty terrible idea." And then the other replies, "The GSEs were a terrible idea, why can't you just admit that?" And then the other replies back, "We just did, and what the fuck happened to your original question?"

Really, it just gives us a headache.

We had these big interconnected undercapitalized things that were mandated by federal policy to keep expanding the amount of paper they bought or backed, which meant inevitably they were going to reach the point where the paper they were backing was too risky, and the GSE’s mandated growth necessarily called for them to issue more paper of their own to do that..And then you had Basel II and its US application that made GSE paper Tier I capital to support maximum loan growth in private sector banks. No wonder credit dried up when the GSEs were taken over in Sept 08. But you never see the Rortys and Mins speak to this perspective.Damn. Thanks for beating the shit out of that strawman, esteemed commentator on Tyler Cowen's blog. Because I can't think of a serious leftwing economist who takes this position. Of course the GSEs where behemoth securitizing entities. Of course they provided liquidity in a market gripped by a bubble. Of course they were pro-cyclical. Of course they should be wound down. But that's not the argument. Because this whole thing kicked off with the question, "Did the GSEs cause the housing bubble?"

Even the most inveterate Kenyan-colonial socialists among us admit that privatising the GSEs was, in retrospect, a pretty significant fuck up. They were pro-cyclical entities backed with a government guarantee, and that's never going to be stabilizing. But that's a contributing, not a causual, factor. They did not cause the crisis; they enabled the other actors in the crisis through a combination of market making and liquidity.

Hating the GSEs is a lot of fun, but saying, "Lookee, it's all their fault" involves ignoring pretty much the entire behaviour of the private-label mortgage originators during the crisis, or the fate of their loan portfolios (yes, compared directly to Fannie and Freddie) after the crisis. The GSEs subprime originations look pretty damn terrible - PLS subprime portfolio performance looks like a goddamn catastrophe.

What we have here are two sets of people talking past each other. One set says, "The GSEs caused the crisis." The other replies, "No, they didn't, because they didn't start the subprime movement, they lost significant market share during the bubble, and even their eventual subprime market offerings fared better than PLS paper. But yeah, they were a pretty terrible idea." And then the other replies, "The GSEs were a terrible idea, why can't you just admit that?" And then the other replies back, "We just did, and what the fuck happened to your original question?"

Really, it just gives us a headache.

Thursday, June 16, 2011

In Which We Scratch Our Heads At Niall Ferguson

It's a well known fact that Niall Ferguson is in highly competitive race to become the Dumbest Man Alive. Whether it's his seminal Newsweek article "Please Obama, Talk More Harshly To The Egyptians, As Though They Could Give A Flying Fuck," or his deeply entertaining follow-up "The Real Problem With Obama Is That He Lacks The Delicate Political Touch Of Richard Nixon" Ferguson has been on a one-man quest to roll back the last shreds of his dignified reputation as a historian.

But these all pale in front of his latest effort, which ran in the June 6 Newsweek. In it, Ferguson excoriates Paul Krugman (the one with the Nobel Prize in economics) for focusing on how darn bad fiscal austerity has been for Ireland, Greece, Portugal, and now Britain.

Sure, Ferguson says. As these countries have cut budgets in the midst of a staggering recession, their economies have stagnated and fallen deeper behind. But no need to worry! Things are fucking cheesy in Switzerland, in spite of some modest budget cuts. So austerity is actually expansionary!

Let us dwell on that for a second.

Switzerland is an incredibly well-educated, export oriented economy that (surprise!) controls it's own currency. Personally, if I were in that situation, I would drive my interest rates to near zero and engage in a coordinated expansion of my monetary base. Plus, I'd let everyone know that since exports are FTW and my currency is a bit on the strong side, I'm planning on keeping them there for as long as I damn well felt like it. But I'm sure Switzerland has done nothing of the sort.

But of course, that's the whole point. Switzerland is nothing like the PIIGS. It's a one-off. More than that, it's not very much like us, either. So after trolling the world economies of 2008-2011, Ferguson has come up with one example where austerity has proven sort-of successful, and asked us to politely ignore Britain, Ireland, Greece, and Portugal.

What's really galling is that Ferguson plainly ignores the rest of Europe. If economics is such a morality tale, then why not look at Spain? Spain was the bees knees, budgetarily speaking. They had slashed their deficit and paid down their debts by half, but it sure didn't help them when the recession came calling. It's almost like the recession had nothing to do with deficits and everything to do with a worldwide collapse in aggregate demand precipitated by a financial crisis and exacerbated by household deleveraging. Funny, that.

So shorter Niall Ferguson: Ignore Britain, Spain, Ireland, Portugal, Italy, Greece, the counterexample of Iceland, the devaulation of the Canadian dollar in the 90s, the Japanese lost decade, and the effect of fiscal stimulus in China. It worked for Switzerland. Ferguson says so.

I have a headache.

But these all pale in front of his latest effort, which ran in the June 6 Newsweek. In it, Ferguson excoriates Paul Krugman (the one with the Nobel Prize in economics) for focusing on how darn bad fiscal austerity has been for Ireland, Greece, Portugal, and now Britain.

Sure, Ferguson says. As these countries have cut budgets in the midst of a staggering recession, their economies have stagnated and fallen deeper behind. But no need to worry! Things are fucking cheesy in Switzerland, in spite of some modest budget cuts. So austerity is actually expansionary!

Let us dwell on that for a second.

Switzerland is an incredibly well-educated, export oriented economy that (surprise!) controls it's own currency. Personally, if I were in that situation, I would drive my interest rates to near zero and engage in a coordinated expansion of my monetary base. Plus, I'd let everyone know that since exports are FTW and my currency is a bit on the strong side, I'm planning on keeping them there for as long as I damn well felt like it. But I'm sure Switzerland has done nothing of the sort.

But of course, that's the whole point. Switzerland is nothing like the PIIGS. It's a one-off. More than that, it's not very much like us, either. So after trolling the world economies of 2008-2011, Ferguson has come up with one example where austerity has proven sort-of successful, and asked us to politely ignore Britain, Ireland, Greece, and Portugal.

What's really galling is that Ferguson plainly ignores the rest of Europe. If economics is such a morality tale, then why not look at Spain? Spain was the bees knees, budgetarily speaking. They had slashed their deficit and paid down their debts by half, but it sure didn't help them when the recession came calling. It's almost like the recession had nothing to do with deficits and everything to do with a worldwide collapse in aggregate demand precipitated by a financial crisis and exacerbated by household deleveraging. Funny, that.

So shorter Niall Ferguson: Ignore Britain, Spain, Ireland, Portugal, Italy, Greece, the counterexample of Iceland, the devaulation of the Canadian dollar in the 90s, the Japanese lost decade, and the effect of fiscal stimulus in China. It worked for Switzerland. Ferguson says so.

I have a headache.

Friday, April 22, 2011

Moral Culpability And The Crisis: Our Least Sexy Title Ever

Ever since we experienced the highly enjoyable financial panic of 2008, people have been casting about for someone to blame. And why not? Every great crisis needs an equally great bad guy. It's fun, and it increases the chance that your abject misery will eventually get optioned into movie rights.

But there's one bad guy that's proving surprisingly popular: The homebuyers themselves. Why not? They were the irresponsible borrowers who took on too much debt, far too soon, and sent the economy into crisis. This is America, after all. If you have to hate someone, you might as well hate the common man.

We're probably behind the ball on this one, seeing as how the recession ended while we were suffering a particularly bad hangover during the entire month of June, 2009, so we should probably let this one go. But we're immodest fellows here at the Strawman Blogger, so late or not, we're going to put this myth to rest.

Don't worry. You can thank us later.

First, let's get a few things out of the way. Homeowners assumed too much debt in the crisis. That much is obvious:

And it also had very predictable consequences:

But participating in a crisis doesn't make you culpable for it. When you buy a home, you work with a team of people: Real estate agents who help you shop for a home, lenders who finance it, and industry experts who provide advice and perspective along the way. Each one earns money when you buy a home. And each one earns more money the more home you buy.

And, during the worst housing bubble in American history, each one argued that a bubble wasn't possible.

Realtors fed that delusion. In 2005, David Lereah, Chief Economist and Senior VP for the National Association of Realtors (NAR), argued that, "[t]here is virtually no risk of a national housing price bubble based on the fundamental demand for housing." In 2006, he predicted a "soft landing for the housing markets." Even as late as October, 2007, the NAR continued to peddle the line that, "[t]he speculative excesses have been removed from the market and home sales are returning to fundamentally health levels."

Nor were they alone. On August 18, 2007, celebrity columnist Ben Stein appeared on Cavuto on Business to state that, "[t]he credit crunch is way overblown ... The subprime problem is a problem, but it's a tiny problem in the context of this economy ... It's a buying opportunity, especially for the financials, maybe like I've never seen before in my entire life.

Financial firms were not immune to the excess. Abetted by the ratings agencies, which catastrophically failed to recognize the growing risks in the mortgage market, large investment banks were net long in housing until the bitter end. Even the previously responsible JPMorgan Chase, which had long avoided the collateralized debt obligation business, was eventually burned by the infamous Magnetar trade, losing $880 million on the Squared CDO alone.

But perhaps the most memorable remark came from then-Fed Chairman Alan Greenspan, who stated, "Although a 'bubble' in home prices for the nation as a whole does not appear likely, there do appear to be, at a minimum, signs of froth in some local markets ... Although we certainly cannot rule out home price declines, especially in some local markets, these declines, were they to occur, likely would not have substantial macroeconomic implications."

Homeowners took on too much debt. More than they could afford. But they didn't do it alone. They did it on the advice of their realtors, who assured them that housing was a good investment. They did it with loans from their banks, who were eager to finance mortgages in any way possible. They did so with liquidity provided by Wall Street, who's addiction to mortgage securitization fueled the crisis. And they did it on the advice and encouragement of financial experts and the Federal Reserve itself.

Each of these actors were experts in their own field. Should home buyers have ignored their advice? Perhaps. But arguing that means admitting that the entire mortgage industry was engaged in an exercise of bad faith - providing bad advice to good people, in hopes of turning a profit.

So who was at fault, you ask? Everyone. And no one. That's the trouble with bubbles. They work because they're so damn convincing. If no one believed in them, they wouldn't happen in the first place.

Well. That, and the bankers, of course.

But there's one bad guy that's proving surprisingly popular: The homebuyers themselves. Why not? They were the irresponsible borrowers who took on too much debt, far too soon, and sent the economy into crisis. This is America, after all. If you have to hate someone, you might as well hate the common man.

We're probably behind the ball on this one, seeing as how the recession ended while we were suffering a particularly bad hangover during the entire month of June, 2009, so we should probably let this one go. But we're immodest fellows here at the Strawman Blogger, so late or not, we're going to put this myth to rest.

Don't worry. You can thank us later.

First, let's get a few things out of the way. Homeowners assumed too much debt in the crisis. That much is obvious:

And it also had very predictable consequences:

But participating in a crisis doesn't make you culpable for it. When you buy a home, you work with a team of people: Real estate agents who help you shop for a home, lenders who finance it, and industry experts who provide advice and perspective along the way. Each one earns money when you buy a home. And each one earns more money the more home you buy.

And, during the worst housing bubble in American history, each one argued that a bubble wasn't possible.

Realtors fed that delusion. In 2005, David Lereah, Chief Economist and Senior VP for the National Association of Realtors (NAR), argued that, "[t]here is virtually no risk of a national housing price bubble based on the fundamental demand for housing." In 2006, he predicted a "soft landing for the housing markets." Even as late as October, 2007, the NAR continued to peddle the line that, "[t]he speculative excesses have been removed from the market and home sales are returning to fundamentally health levels."

Nor were they alone. On August 18, 2007, celebrity columnist Ben Stein appeared on Cavuto on Business to state that, "[t]he credit crunch is way overblown ... The subprime problem is a problem, but it's a tiny problem in the context of this economy ... It's a buying opportunity, especially for the financials, maybe like I've never seen before in my entire life.

Financial firms were not immune to the excess. Abetted by the ratings agencies, which catastrophically failed to recognize the growing risks in the mortgage market, large investment banks were net long in housing until the bitter end. Even the previously responsible JPMorgan Chase, which had long avoided the collateralized debt obligation business, was eventually burned by the infamous Magnetar trade, losing $880 million on the Squared CDO alone.

But perhaps the most memorable remark came from then-Fed Chairman Alan Greenspan, who stated, "Although a 'bubble' in home prices for the nation as a whole does not appear likely, there do appear to be, at a minimum, signs of froth in some local markets ... Although we certainly cannot rule out home price declines, especially in some local markets, these declines, were they to occur, likely would not have substantial macroeconomic implications."

Homeowners took on too much debt. More than they could afford. But they didn't do it alone. They did it on the advice of their realtors, who assured them that housing was a good investment. They did it with loans from their banks, who were eager to finance mortgages in any way possible. They did so with liquidity provided by Wall Street, who's addiction to mortgage securitization fueled the crisis. And they did it on the advice and encouragement of financial experts and the Federal Reserve itself.

Each of these actors were experts in their own field. Should home buyers have ignored their advice? Perhaps. But arguing that means admitting that the entire mortgage industry was engaged in an exercise of bad faith - providing bad advice to good people, in hopes of turning a profit.

So who was at fault, you ask? Everyone. And no one. That's the trouble with bubbles. They work because they're so damn convincing. If no one believed in them, they wouldn't happen in the first place.

Well. That, and the bankers, of course.

Labels:

debt,

financial crisis,

Great Recession,

greenspan,

jpmorgan,

realtors

Tuesday, April 19, 2011

We Could Do Something Stupider Than This, But We Wouldn't Want To Try

So even reasonable and adult Americans have lately been making sounds about refusing to raise the debt ceiling. Not at least without some smidgen of compromise, which will no doubt involve putting poor people in ankle shackles and driving them through the streets.

Honestly, this is so monumentally stupid that we actually be surprised, if we weren't such a cynical and worldly fellow. Let us be utterly clear on this point. Refusing to raise the debt ceiling doesn't change a single thing about our prolifigate, irresponsible, and altogether ill-considered spending. It just means that we refuse to pay the bills.

To put it another way: If the United States of America was you, refusing to raise the debt ceiling would be like refusing to pay your mortgage. I wonder how that would turn out?

Why is it that nominally intelligent people can't grasp this? If you want to do something about spending, cut spending. If you want to raise more in taxes, raise taxes. What you should NOT do, under any circumstances, is willingly default on the national debt simply because you want Medicare benefits issued in chickens.

This is not a bloody game. In 2008, led by a serious mispricing of extant market risk, the mortgage securities market suffered a massive panic and commisserate flight to safety, which crushed security prices and drove down Treasury yields. The inability of the market to supply a co-equal supply of new safe assets led to a collapse in aggregate demand that, along with global deleverging, threw the economy into a massive recession.

That's what happens when investors doubt the safety of MBSs and CDOs. Imagine what happens when the United States regularly, and for no reason other than it's simple bloodymindedness, starts defaulting on it's debt.

Honestly, this is so monumentally stupid that we actually be surprised, if we weren't such a cynical and worldly fellow. Let us be utterly clear on this point. Refusing to raise the debt ceiling doesn't change a single thing about our prolifigate, irresponsible, and altogether ill-considered spending. It just means that we refuse to pay the bills.

To put it another way: If the United States of America was you, refusing to raise the debt ceiling would be like refusing to pay your mortgage. I wonder how that would turn out?

Why is it that nominally intelligent people can't grasp this? If you want to do something about spending, cut spending. If you want to raise more in taxes, raise taxes. What you should NOT do, under any circumstances, is willingly default on the national debt simply because you want Medicare benefits issued in chickens.

This is not a bloody game. In 2008, led by a serious mispricing of extant market risk, the mortgage securities market suffered a massive panic and commisserate flight to safety, which crushed security prices and drove down Treasury yields. The inability of the market to supply a co-equal supply of new safe assets led to a collapse in aggregate demand that, along with global deleverging, threw the economy into a massive recession.

That's what happens when investors doubt the safety of MBSs and CDOs. Imagine what happens when the United States regularly, and for no reason other than it's simple bloodymindedness, starts defaulting on it's debt.

Wednesday, April 13, 2011

Better Than We Expected, Obama, But Can't Anyone Really Play This Game?

So we're pleased to announce that Obama's budget proposal was better than expected. But that was mostly because we expected him to put Harry Reid in shackles and throw him into a pool filled with live sharks. Really, this is the type of stone-cold bargaining you get from the 44th President of the United States.

Really, negotiating with Obama is easier than beating a sackful of kittens, provided you're a Republican. It's a simple two step process. Start by abandoning your position. Then, shift your views just to the right of Attila the Hun. Then wait! Obama will inevitably assume your old position, meaning that you get the triple benefit of a) seeing your original plan passed, b) getting to push the American political debate to the far right, and c) being able to excoriate the President as a socialist for having the temerity of trying to pass a plan your originally supported.1 2

Success!

We can't blame Republicans, though. It only worked 1,293,939 times before Obama showed signs of catching on. And today he did, with a plan that was only tilted 3:1 in favor of spending cuts over tax increases, as opposed to the plan Paul Ryan favors, which involves striking the American middle class on the head with a large cartoon mallet before giving out tax breaks to super-rich bankers.

Still, while 3:1 is a marginal improvement compared to a plan that is actively insane, we feel we could do one better. So with no further ado, we present the Strawman Blogger Guide To Fixing America's Budget. You can thank us later.

The Strawman Blogger Guide To Fixing America's Budget: The Short Version

"Dear Americans. What a stupid fucking debate we are having. Truly, I can think of nothing more productive than slashing spending in the middle of an anemic recovery after a crushing recession. Real GDP growth is being revised downward, from 1.9% to about 1.5%. Shit, I thought the first number was bad. It’s like we’re actually scared of returning to full employment."

"Still, much like a crank addict after a four-day dry spell, you demand more of what's killin' ya. So far be it for me to complain. What follows is my edifying and entirely reasonable plan for fixing the budget."

"Our long term deficit is caused by nothing more than Medicare. Luckily, the Affordable Care Act had many promising cost controls that even Ryan recognized and kept in his plan, so I plan to defend and promote that act to help correct the path of the Medicare cost curve.”

“Our medium term deficit is exacerbated by the irresponsibility of the unfunded Bush tax breaks, many for the richest Americans. In this time of shared sacrifice, I’ll let those expire. Social Security, on the other hand, is fundamentally sound. Its minor budget problems can almost entirely solved by lifting the payroll tax cap, so I’ll veto any bill that cuts benefits and puts retirees at further risk of poverty. The non-defense discretionary budget is not the driver of our long term deficit, so while I welcome reforms, accountability, and the right priorities, I won’t accept cuts to the social programs that assist the needy and promote the well being of the our country, like Pell Grants, child nutrition, or funds for scientific research.”

“Finally, our short term budget deficit it caused by the collapsing tax revenues due to this recession. As good, honest, hard working Americans struggle to find jobs, they have more need of programs like unemployment insurance and pay less in taxes. Solving this problem means putting America back to work. So I will follow with plans for short term deficit spending to increase demand, spur jobs, and make it easier for business to hire. I also believe that the Federal Reserve is staffed by of a bunch of arrogant white mincing venal ex-investment bankers who’s minds have long ago been wasted away by the furious pace of their socially damaging rent-seeking, and as a result are too childish, close minded, and blinded by epistemic closure to notice that their slavish ignorance of 8.9% unemployment and below-average inflation is destroying the country. So here are my list of nominations for all vacant Fed chairs.”

“While Republicans may have you believe that we can afford our society, but not accept the adult responsibility of paying for it, I know that Americans are mature enough to believe differently. What we pay for our government has not changed substantially over the last fifty years. Outside of health, the cost of our government has not changed substantially in forty years. But our taxes have changed. We pay less today than at any other time in modern history. Most of all the rich, who have appropriated the fruits of this country's labor while advocating the ridiculous notion that they have no responsibility to pay for its care. That is got to change.”

Then I’d have graphs. I fucking love me a graph.

1Great example of this: The Affordable Care Act, which we prefer to call the Dole/Daschle Health Care Care Plan Of Awesomeness.

2Another great example of this: The 2011 budget fight, which played out like this. REPUBLICANS: We demand 33 billion in cuts! DEMOCRATS: Never! REPUBLICANS: Then we demand 70 billion in cuts! DEMOCRATS: How about 38 billion? REPUBLICANS: Socialists! But ok.

Really, negotiating with Obama is easier than beating a sackful of kittens, provided you're a Republican. It's a simple two step process. Start by abandoning your position. Then, shift your views just to the right of Attila the Hun. Then wait! Obama will inevitably assume your old position, meaning that you get the triple benefit of a) seeing your original plan passed, b) getting to push the American political debate to the far right, and c) being able to excoriate the President as a socialist for having the temerity of trying to pass a plan your originally supported.1 2

Success!

We can't blame Republicans, though. It only worked 1,293,939 times before Obama showed signs of catching on. And today he did, with a plan that was only tilted 3:1 in favor of spending cuts over tax increases, as opposed to the plan Paul Ryan favors, which involves striking the American middle class on the head with a large cartoon mallet before giving out tax breaks to super-rich bankers.

Still, while 3:1 is a marginal improvement compared to a plan that is actively insane, we feel we could do one better. So with no further ado, we present the Strawman Blogger Guide To Fixing America's Budget. You can thank us later.

The Strawman Blogger Guide To Fixing America's Budget: The Short Version

"Dear Americans. What a stupid fucking debate we are having. Truly, I can think of nothing more productive than slashing spending in the middle of an anemic recovery after a crushing recession. Real GDP growth is being revised downward, from 1.9% to about 1.5%. Shit, I thought the first number was bad. It’s like we’re actually scared of returning to full employment."

"Still, much like a crank addict after a four-day dry spell, you demand more of what's killin' ya. So far be it for me to complain. What follows is my edifying and entirely reasonable plan for fixing the budget."

"Our long term deficit is caused by nothing more than Medicare. Luckily, the Affordable Care Act had many promising cost controls that even Ryan recognized and kept in his plan, so I plan to defend and promote that act to help correct the path of the Medicare cost curve.”

“Our medium term deficit is exacerbated by the irresponsibility of the unfunded Bush tax breaks, many for the richest Americans. In this time of shared sacrifice, I’ll let those expire. Social Security, on the other hand, is fundamentally sound. Its minor budget problems can almost entirely solved by lifting the payroll tax cap, so I’ll veto any bill that cuts benefits and puts retirees at further risk of poverty. The non-defense discretionary budget is not the driver of our long term deficit, so while I welcome reforms, accountability, and the right priorities, I won’t accept cuts to the social programs that assist the needy and promote the well being of the our country, like Pell Grants, child nutrition, or funds for scientific research.”

“Finally, our short term budget deficit it caused by the collapsing tax revenues due to this recession. As good, honest, hard working Americans struggle to find jobs, they have more need of programs like unemployment insurance and pay less in taxes. Solving this problem means putting America back to work. So I will follow with plans for short term deficit spending to increase demand, spur jobs, and make it easier for business to hire. I also believe that the Federal Reserve is staffed by of a bunch of arrogant white mincing venal ex-investment bankers who’s minds have long ago been wasted away by the furious pace of their socially damaging rent-seeking, and as a result are too childish, close minded, and blinded by epistemic closure to notice that their slavish ignorance of 8.9% unemployment and below-average inflation is destroying the country. So here are my list of nominations for all vacant Fed chairs.”

“While Republicans may have you believe that we can afford our society, but not accept the adult responsibility of paying for it, I know that Americans are mature enough to believe differently. What we pay for our government has not changed substantially over the last fifty years. Outside of health, the cost of our government has not changed substantially in forty years. But our taxes have changed. We pay less today than at any other time in modern history. Most of all the rich, who have appropriated the fruits of this country's labor while advocating the ridiculous notion that they have no responsibility to pay for its care. That is got to change.”

Then I’d have graphs. I fucking love me a graph.

1Great example of this: The Affordable Care Act, which we prefer to call the Dole/Daschle Health Care Care Plan Of Awesomeness.

2Another great example of this: The 2011 budget fight, which played out like this. REPUBLICANS: We demand 33 billion in cuts! DEMOCRATS: Never! REPUBLICANS: Then we demand 70 billion in cuts! DEMOCRATS: How about 38 billion? REPUBLICANS: Socialists! But ok.

Thoughts That Still Mystify Us, Part 2

Our entire medium-term deficit problem can be solved by repealing the Bush-era tax cuts, which fans of deficit spending will be pleased to recall were entirely financed on the nation's credit card. Not that we're complaining! It takes really committed ignorance to reduce taxes to their lowest levels in modern history.

Thoughts That Still Mystify Us, Part 1

The exchanges in Paul Ryan's Plan are almost entirely indistinguishable from the exchanges in the Affordable Care Act. What the hell, people? Is no one going to talk about this?1

1Also, he keeps the Medicare cuts that sent seniors everywhere flocking to their fainting couches. And that he called unsustainable. Bless.

1Also, he keeps the Medicare cuts that sent seniors everywhere flocking to their fainting couches. And that he called unsustainable. Bless.

Thursday, April 7, 2011

On Our Plan For Despair, Eh, Prosperity. Whatever.

Regular readers will note that we've so far been mum on the Ryan budget, truly the news of the past week. This has not been a mistake! In the past, we've rushed willy-nilly into the political fray whenever the mood struck us, making all types of regrettable factual errors along the way, along with assorted logical mistakes and embarrassing missteps that frankly we'd all like to forget.

So we've decided to be a cleverer, more patient Strawman Blogger. We're no longer trying to crest the wave of high-frequency snark, but instead follow behind with our pithy insight and vast wisdom.

In that spirit, we've decided to make a quick list of the major points of contention with Ryan's budget. Why a list, you ask? Truly we despair over lists, being as they are tools of weak minds desperate for easy page hits, but in this case we had to relent. If we picked a single topic for each blog post on the budget, the Strawman Blogger front page would quickly stretch into infinity.

That's right. The Ryan Budget: A plan so stupid that a single blog post cannot contain it. Well done all around.

Without further ado, our late (but somewhat more refined) thoughts:

1) The Great Risk Shift

If you care about the deficit, you care about health care. No factor is important to the growth of our long run debt except for the grinding, implacably rising costs of health service. So naturally, if you want to fix the debt problem, your only concern is in changing the trend curve of health care costs.

Fix, you see, is the key word here.

Ryan doesn't fix anything. To his immense credit, he doesn't even try. He doesn't establish new payment practices, doesn't delve deeper into the efficacy of care, and doesn't bother to address the many deficiencies in our current system. He simply ends Medicare. If you turn 65 in 2022, you won't enroll in Medicare. You'll get a voucher which you can use to purchase private insurance.

Vouchers? Well. Premium support payments, in his remarkable lexicon.

As we discuss below, these vouchers grow far slower than your cost of care. So over time your vouchers will be worth less and less and you'll purchase less and less care with them.

Medicare costs are not sustainable over 50 years. But shifting this deficit from the government to the individual doesn't fix health care costs. It just dumps them off the ledger. Seniors will still lack care, will still be indebted far past their ability to pay - but with Ryan's deep cuts and without the support of a strong bargaining position, their suffering will be much more acute. According to the CBO, Ryan's plan will double the out-of-pocket cost of health care. Forget insurance. Over 68% of seniorshealth care insurance premiums will be paid by seniors themselves.

This isn't problem-solving. This is willful childish ignorance. Apparently, Ryan attended the Hear, See, and Speak No Evil school of policy design.

2) CPI-U And The Rate Of Inflation

When Ryan first teased hints of his plan, the general thought among the intelligentsia was that he would tie the value of his vouchers to GDP+1%. They also declared that this formula was totally unsustainable. Health care costs grow at some 5% per annum, so anyone holding a voucher will be able to buy less and less in care as the years tick by.

It turns out, however, that even that ambitious stupidity wasn't enough for Ryan. He linked his vouchers to the CPI-U – the rate of general inflation.

To put this in perspective, you can think of the growth in GDP to be the growth in productivity added to the rate of inflation (thanks to Ezra Klein for the breakdown). Ryan has taken a formula that's already too harsh for seniors (Voucher Growth = Production + Inflation + 1%) and made it far, far worse (Vg = I).

Why did he do this? God knows. Klein posits, correctly we think, that when he plugged GDP+1% into his formula he couldn't get it to spit out the savings he wanted.

3) In Which The Heritage Foundation Embarrasses Themselves Somewhat More Than Usual

Once Ryan had put the polish on his plan, he took it over to the fine folks at the Heritage Foundation to have them model the macroeconomic effects1. Not that you could call it modelling, mind. Math like this is why people don't trust economists.

First, it's important to note that the Heritage Foundation projections aren't needed for the plan to work. Ryan's plan makes deep cuts, and those cuts will be effective quite apart from the Heritage analysis. It's worth stating as there's been some confusion on that point.

However, taking the hammer to the social safety net without providing any actual benefits is considered bad form, so Ryan asked the folks at Heritage to break out the trumpet divine and bring the good news. And they did! Sort of.

Heritage found the plan so impressive, so remarkably magical, that they predicted that just enacting it would reduce unemployment to 6.4% by the end of the year. Sweet God, man! That's some powerful stuff.

Not only that, but they posit that unemployment will hit 2.5% in 2020.

Yes. We meant to write that.

...

2.5%.

Let's put that in perspective. Unemployment has only been below 4% once in the last thirty years, and that was immediately followed by a Fed rate hike. It's important to understand why. It takes time for people to find a job. It takes more time to find a job that's right for them. If you imagined a world with 0% unemployment, those unlucky fellows who are fired would be hired the very second they walked out the door.

This, of course, is unlikely.

So any economy has a natural non-zero rate of unemployment. For reasons to lengthy to discuss here, any attempt to drive unemployment below that rate will cause inflation to pick up. To whit, it's commonly called the Non-Accelerating Inflation Rate of Unemployment (NAIRU). Once unemployment hits the NAIRU, inflation ticks up and the Fed steps in with a timely rate hike.

The NAIRU can change, but it's generally between 4-5% in a healthy economy. So to the profound merriment of assorted spectators, the Heritage Foundation declared that Ryan's Roadmap was so powerful that it would actually rewrite the basic rules of macroeconomics.

And you know what? It gets better.

After several days of highly enjoyable mockery, the Heritage Foundation deleted the offending table from their website. This was a mistake for reasons three. 1) It is 2011 and, thanks to the timely invention of the PrntScn key, the original table was widely available 2) You can still calculate the 2.8% rate from the rest of their datasets, and 3) By taking a ridiculous idea that no one but Heritage believed and turning into a ridiculous idea that even Heritage couldn't stand behind, it naturally made the rest of their rosy numbers look rather suspect.2

4) Oh. Also He Sort Of Ends Medicaid.

The current funding mechanism for Medicaid will be ended and states will be given block grants instead. We don't have much to say about this, except to note that, warts and all, Medicaid is the single most effective service at holding down health care costs. It is probably the opposite direction than where we should be heading.

5) Really. Really, This Looks A Lot Like The Affordable Care Act

Remember the no good awful socialist Affordable Care Act? It worked sort of like this:

Now, we aren't saying that you have to hate Ryan's plan just because you hated ObamaCare. We, for example, made our peace with the Affordable Care Act because a) no one looked especially inclined to give us single-payer, and b) giving crappy insurance to previously uninsured sick people looked like a step in the right direction. Ryan, however, is planning giving extremely crappy insurance to a bunch of old people who currently have perfectly good insurance, thank you very much, before taking the extra step of making it even more crappy over time.

Needless to say, we are unamused.

But while you can hate/love ObamaCare and RyanCare with perfect logical consistency, you cannot actually consider ObamaCare a socialist takeover and RyanCare a triumph of the free market. Please, people. You have to at least look like you're trying.

5) It's Not Just Medicare

It's also worth mentioning that Ryan finds time to increase taxes on most of the bottom 90% of society, while reducing taxes on the top 10%. The top 1% saves rather a lot, actually - about 15% of income.

He also, in an astonishingly crazy fashion, promises to reduce all other spending, apart from medicine and social security, from 12% of GDP to 3.5%. Since he's promised only cursory cuts to defense, the damage to the social programs in non-defense discretionary, such as food stamps and Pell grants, will likely be catastrophic.

6) If It's Such A Bloody Good Idea: Why Not Now?

One final, and in our eyes, most damning question. If Ryan's plan is so effective, if it really holds down the costs of care, results in major savings, promotes individual choice, but in no way damages the efficacy of health care - why wait? Why not start it now?

You would need time, of course, to get the exchanges up and running. ObamaCare needed four years - we'll round it up to five, just to give Ryan the benefit of the doubt. Five years to set up the exchanges, and in 2016 Medicare ends and every once and future senior gets a voucher for care.

Sound good?

It doesn't to Ryan. It doesn't because it's a terrible plan and seniors reliably vote Republican. So in an extreme act of cowardice, Ryan reverses course. No one over the age of 55 will be affected. This isn't "save the future for our children." It's "save the present, screw the future."

As others have pointed out, this creates a completely unsustainable political dynamic. Seniors turning 65 in 2022 will see their peers get lavish Medicare benefits, while they're sent scurrying for scraps in the wasteland of the exchanges. This is hardly going to last. Ryan's plan isn't just cruel and irresponsible. It's cruel and irresponsible and unlikely to work.

In Close

All in all, we're bemused by Ryan's plan. If we had set our enviable intellect to the task of creating a plan that would be hated by the public, pilloried by the Democrats, and be the mass political suicide of the Republicans, we could not have done better.

We reserve the right to add to this post as the mood strikes us.

Update: An earlier version of this blog incorrectly stated that seniors would pay for 68% of their health care costs under Ryan's plan. The CBO estimated that they will pay for 68% of their insurance premiums.

Update, Again: In what can only be described as a divine taste for cruel irony, the original version of this blog had extensive errors. See? We told you we shouldn't have rushed into anything. The original confused the Plan For Prosperity budget with Ryan's Roadmap, which would have been only a minor irritation, except we linked to the wrong CBO report. Mentions of the Roadmap have been corrected and the link has been fixed. The percentage of insurance premiums was actually correct. At least we didn't screw that up twice.

1Other picks from the Heritage Foundation highlight reel: The Bush tax cuts will increase household income and the Bush tax cuts will pay off our national debt by 2010.

2As of writing this, they just took down the entirety of their original forecast and replaced it with something marginally less insane. Very marginally. Small improvements, and all that.

So we've decided to be a cleverer, more patient Strawman Blogger. We're no longer trying to crest the wave of high-frequency snark, but instead follow behind with our pithy insight and vast wisdom.

In that spirit, we've decided to make a quick list of the major points of contention with Ryan's budget. Why a list, you ask? Truly we despair over lists, being as they are tools of weak minds desperate for easy page hits, but in this case we had to relent. If we picked a single topic for each blog post on the budget, the Strawman Blogger front page would quickly stretch into infinity.

That's right. The Ryan Budget: A plan so stupid that a single blog post cannot contain it. Well done all around.

Without further ado, our late (but somewhat more refined) thoughts:

1) The Great Risk Shift

If you care about the deficit, you care about health care. No factor is important to the growth of our long run debt except for the grinding, implacably rising costs of health service. So naturally, if you want to fix the debt problem, your only concern is in changing the trend curve of health care costs.

Fix, you see, is the key word here.

Ryan doesn't fix anything. To his immense credit, he doesn't even try. He doesn't establish new payment practices, doesn't delve deeper into the efficacy of care, and doesn't bother to address the many deficiencies in our current system. He simply ends Medicare. If you turn 65 in 2022, you won't enroll in Medicare. You'll get a voucher which you can use to purchase private insurance.

Vouchers? Well. Premium support payments, in his remarkable lexicon.

As we discuss below, these vouchers grow far slower than your cost of care. So over time your vouchers will be worth less and less and you'll purchase less and less care with them.

Medicare costs are not sustainable over 50 years. But shifting this deficit from the government to the individual doesn't fix health care costs. It just dumps them off the ledger. Seniors will still lack care, will still be indebted far past their ability to pay - but with Ryan's deep cuts and without the support of a strong bargaining position, their suffering will be much more acute. According to the CBO, Ryan's plan will double the out-of-pocket cost of health care. Forget insurance. Over 68% of seniors

This isn't problem-solving. This is willful childish ignorance. Apparently, Ryan attended the Hear, See, and Speak No Evil school of policy design.

2) CPI-U And The Rate Of Inflation

When Ryan first teased hints of his plan, the general thought among the intelligentsia was that he would tie the value of his vouchers to GDP+1%. They also declared that this formula was totally unsustainable. Health care costs grow at some 5% per annum, so anyone holding a voucher will be able to buy less and less in care as the years tick by.

It turns out, however, that even that ambitious stupidity wasn't enough for Ryan. He linked his vouchers to the CPI-U – the rate of general inflation.

To put this in perspective, you can think of the growth in GDP to be the growth in productivity added to the rate of inflation (thanks to Ezra Klein for the breakdown). Ryan has taken a formula that's already too harsh for seniors (Voucher Growth = Production + Inflation + 1%) and made it far, far worse (Vg = I).

Why did he do this? God knows. Klein posits, correctly we think, that when he plugged GDP+1% into his formula he couldn't get it to spit out the savings he wanted.

3) In Which The Heritage Foundation Embarrasses Themselves Somewhat More Than Usual

Once Ryan had put the polish on his plan, he took it over to the fine folks at the Heritage Foundation to have them model the macroeconomic effects1. Not that you could call it modelling, mind. Math like this is why people don't trust economists.

First, it's important to note that the Heritage Foundation projections aren't needed for the plan to work. Ryan's plan makes deep cuts, and those cuts will be effective quite apart from the Heritage analysis. It's worth stating as there's been some confusion on that point.

However, taking the hammer to the social safety net without providing any actual benefits is considered bad form, so Ryan asked the folks at Heritage to break out the trumpet divine and bring the good news. And they did! Sort of.

Heritage found the plan so impressive, so remarkably magical, that they predicted that just enacting it would reduce unemployment to 6.4% by the end of the year. Sweet God, man! That's some powerful stuff.

Not only that, but they posit that unemployment will hit 2.5% in 2020.

Yes. We meant to write that.

...

2.5%.

Let's put that in perspective. Unemployment has only been below 4% once in the last thirty years, and that was immediately followed by a Fed rate hike. It's important to understand why. It takes time for people to find a job. It takes more time to find a job that's right for them. If you imagined a world with 0% unemployment, those unlucky fellows who are fired would be hired the very second they walked out the door.

This, of course, is unlikely.

So any economy has a natural non-zero rate of unemployment. For reasons to lengthy to discuss here, any attempt to drive unemployment below that rate will cause inflation to pick up. To whit, it's commonly called the Non-Accelerating Inflation Rate of Unemployment (NAIRU). Once unemployment hits the NAIRU, inflation ticks up and the Fed steps in with a timely rate hike.

The NAIRU can change, but it's generally between 4-5% in a healthy economy. So to the profound merriment of assorted spectators, the Heritage Foundation declared that Ryan's Roadmap was so powerful that it would actually rewrite the basic rules of macroeconomics.

And you know what? It gets better.

After several days of highly enjoyable mockery, the Heritage Foundation deleted the offending table from their website. This was a mistake for reasons three. 1) It is 2011 and, thanks to the timely invention of the PrntScn key, the original table was widely available 2) You can still calculate the 2.8% rate from the rest of their datasets, and 3) By taking a ridiculous idea that no one but Heritage believed and turning into a ridiculous idea that even Heritage couldn't stand behind, it naturally made the rest of their rosy numbers look rather suspect.2

4) Oh. Also He Sort Of Ends Medicaid.

The current funding mechanism for Medicaid will be ended and states will be given block grants instead. We don't have much to say about this, except to note that, warts and all, Medicaid is the single most effective service at holding down health care costs. It is probably the opposite direction than where we should be heading.

5) Really. Really, This Looks A Lot Like The Affordable Care Act

Remember the no good awful socialist Affordable Care Act? It worked sort of like this:

- People received need-based vouchers for care

- People were able to shop and compare private plans on health care Exchanges

- The plans in the Exchanges had to meet a basic quality

- The plans were extremely limited in their ability to discriminate with price

- Seniors receive need-based vouchers for care

- Seniors are able to shop and compare private plans on health care Exchanges

- The plans on the Exchanges have to meet a basic quality

- The plans are limited in their ability to discriminate with price

Now, we aren't saying that you have to hate Ryan's plan just because you hated ObamaCare. We, for example, made our peace with the Affordable Care Act because a) no one looked especially inclined to give us single-payer, and b) giving crappy insurance to previously uninsured sick people looked like a step in the right direction. Ryan, however, is planning giving extremely crappy insurance to a bunch of old people who currently have perfectly good insurance, thank you very much, before taking the extra step of making it even more crappy over time.

Needless to say, we are unamused.

But while you can hate/love ObamaCare and RyanCare with perfect logical consistency, you cannot actually consider ObamaCare a socialist takeover and RyanCare a triumph of the free market. Please, people. You have to at least look like you're trying.

5) It's Not Just Medicare

It's also worth mentioning that Ryan finds time to increase taxes on most of the bottom 90% of society, while reducing taxes on the top 10%. The top 1% saves rather a lot, actually - about 15% of income.

He also, in an astonishingly crazy fashion, promises to reduce all other spending, apart from medicine and social security, from 12% of GDP to 3.5%. Since he's promised only cursory cuts to defense, the damage to the social programs in non-defense discretionary, such as food stamps and Pell grants, will likely be catastrophic.

6) If It's Such A Bloody Good Idea: Why Not Now?

One final, and in our eyes, most damning question. If Ryan's plan is so effective, if it really holds down the costs of care, results in major savings, promotes individual choice, but in no way damages the efficacy of health care - why wait? Why not start it now?

You would need time, of course, to get the exchanges up and running. ObamaCare needed four years - we'll round it up to five, just to give Ryan the benefit of the doubt. Five years to set up the exchanges, and in 2016 Medicare ends and every once and future senior gets a voucher for care.

Sound good?

It doesn't to Ryan. It doesn't because it's a terrible plan and seniors reliably vote Republican. So in an extreme act of cowardice, Ryan reverses course. No one over the age of 55 will be affected. This isn't "save the future for our children." It's "save the present, screw the future."

As others have pointed out, this creates a completely unsustainable political dynamic. Seniors turning 65 in 2022 will see their peers get lavish Medicare benefits, while they're sent scurrying for scraps in the wasteland of the exchanges. This is hardly going to last. Ryan's plan isn't just cruel and irresponsible. It's cruel and irresponsible and unlikely to work.

In Close

All in all, we're bemused by Ryan's plan. If we had set our enviable intellect to the task of creating a plan that would be hated by the public, pilloried by the Democrats, and be the mass political suicide of the Republicans, we could not have done better.

We reserve the right to add to this post as the mood strikes us.

Update: An earlier version of this blog incorrectly stated that seniors would pay for 68% of their health care costs under Ryan's plan. The CBO estimated that they will pay for 68% of their insurance premiums.

Update, Again: In what can only be described as a divine taste for cruel irony, the original version of this blog had extensive errors. See? We told you we shouldn't have rushed into anything. The original confused the Plan For Prosperity budget with Ryan's Roadmap, which would have been only a minor irritation, except we linked to the wrong CBO report. Mentions of the Roadmap have been corrected and the link has been fixed. The percentage of insurance premiums was actually correct. At least we didn't screw that up twice.

1Other picks from the Heritage Foundation highlight reel: The Bush tax cuts will increase household income and the Bush tax cuts will pay off our national debt by 2010.

2As of writing this, they just took down the entirety of their original forecast and replaced it with something marginally less insane. Very marginally. Small improvements, and all that.

Tuesday, March 22, 2011

This Is Not The Way Forward

Lately, we're getting a bit desperate for topics to discuss that don't make us sound too much like an unhinged foaming partisan hack. It's not easy. We're very excitable around this blog.

Still, sounding like you're a few screws short of marching out of a fifteenth-story window is really not the way to appeal to a broad demographic of readership. Although, quite frankly, it would be quite the feat for our readership to go any lower. Perhaps if we closed our eyes when posting?

So over the next few weeks, we'll discussing some calmer, more cerebral topics that don't get us all in a lather. That's right. You're about to be treated a rational Strawman Blogger. Probably. At least until such a time as we go off our meds.

We'll start with Libya. We're calm about Libya. Partially because we're an insular, narrow-minded American with a shaky grasp of geography, but mostly because it's a messy regional conflict, and it's unlikely that anyone in America would be dim enough to needlessly entangle themselves in a war with no clear good guys, uncertain prospects, and no clear timeline for resolution.

What's that? Eh? Oh.

We really cannot fathom the mindset that has led the administration to believe that lobbing cruise missiles over sky of north Africa is a good idea, other than that we have some lying around and someone thought it would be fun. But as a military tactic? That kind of assumes that the one thing preventing the rebels from sweeping into power in Western Libya is a Tomahawk strike. Call us unconvinced.

Now, it's entirely possible that proper air support will do a world of good for the rebels. As our wiser friends have pointed out, it's not like Ghaddafi's army is exceptionally large or well-organized, and the fact that a fair portion of it consists of the local hired help is unlikely to improve long-term morale. But historically, air campaigns have not been terribly successful at disloding committed opponents. Battle of Britian, Kosovo, and ect. and so on. As it turns out, it is difficult to occupy a country with an F-22.

Apart from the success of the campaign, we really question the point of getting involved in the first place. Look, people. War sucks. It sucks a little bit for a lot of people, and it sucks much much worse for the few people we ask to do all the fighting. All in all, it's something to be avoided as much as possible.

But if the goal is important, and if it helps secure American interests, than sometimes the dirty work becomes necessary dirty work. And as the saying goes, if something is worth doing, it's worth doing right.

So the question remains: Is Libya important to America? If so, then why are we wasting our time faffing about with cruise missiles when something more direct is required? And if it's not - well, why are we still faffing about with cruise missiles?

The answer, of course, is that it's easy. Americans are not highly bothered when a bomb lands on the head of a civilian, provided it does so outside a comfortable several thousand mile radius. But they are very bothered when American soldiers are put in harms way. To avoid stressing anyone out, our default option becomes an expensive air campaign of questionable merit, even if it's not likely to produce any good result, simply because no one is going to object.

So there you go. We do, of course, hope it all works out for the best. Previous comparisons aside, Quaddafi is not terribly well entrenched. But it does make one wonder.

Still, sounding like you're a few screws short of marching out of a fifteenth-story window is really not the way to appeal to a broad demographic of readership. Although, quite frankly, it would be quite the feat for our readership to go any lower. Perhaps if we closed our eyes when posting?

So over the next few weeks, we'll discussing some calmer, more cerebral topics that don't get us all in a lather. That's right. You're about to be treated a rational Strawman Blogger. Probably. At least until such a time as we go off our meds.

We'll start with Libya. We're calm about Libya. Partially because we're an insular, narrow-minded American with a shaky grasp of geography, but mostly because it's a messy regional conflict, and it's unlikely that anyone in America would be dim enough to needlessly entangle themselves in a war with no clear good guys, uncertain prospects, and no clear timeline for resolution.

What's that? Eh? Oh.

We really cannot fathom the mindset that has led the administration to believe that lobbing cruise missiles over sky of north Africa is a good idea, other than that we have some lying around and someone thought it would be fun. But as a military tactic? That kind of assumes that the one thing preventing the rebels from sweeping into power in Western Libya is a Tomahawk strike. Call us unconvinced.

Now, it's entirely possible that proper air support will do a world of good for the rebels. As our wiser friends have pointed out, it's not like Ghaddafi's army is exceptionally large or well-organized, and the fact that a fair portion of it consists of the local hired help is unlikely to improve long-term morale. But historically, air campaigns have not been terribly successful at disloding committed opponents. Battle of Britian, Kosovo, and ect. and so on. As it turns out, it is difficult to occupy a country with an F-22.

Apart from the success of the campaign, we really question the point of getting involved in the first place. Look, people. War sucks. It sucks a little bit for a lot of people, and it sucks much much worse for the few people we ask to do all the fighting. All in all, it's something to be avoided as much as possible.

But if the goal is important, and if it helps secure American interests, than sometimes the dirty work becomes necessary dirty work. And as the saying goes, if something is worth doing, it's worth doing right.

So the question remains: Is Libya important to America? If so, then why are we wasting our time faffing about with cruise missiles when something more direct is required? And if it's not - well, why are we still faffing about with cruise missiles?

The answer, of course, is that it's easy. Americans are not highly bothered when a bomb lands on the head of a civilian, provided it does so outside a comfortable several thousand mile radius. But they are very bothered when American soldiers are put in harms way. To avoid stressing anyone out, our default option becomes an expensive air campaign of questionable merit, even if it's not likely to produce any good result, simply because no one is going to object.

So there you go. We do, of course, hope it all works out for the best. Previous comparisons aside, Quaddafi is not terribly well entrenched. But it does make one wonder.

Monday, March 21, 2011

A Moment Of Bipartisanship

You want to know what’s awesome? Congress. 64 senators just wrote a letter to the White House begging the president to take the lead in reducing the deficit. Yes! That president! The executive head of the United States who's involvement in passing legislation involves a) signing it, or b) asking Congress to pass it so he can sign it.

The Senate, on the other hand, used to be the body we regularly trusted with passing laws. And sixty four (64!) Senators have signed this, in spite of the fact that you could not normally get more than eight to agree on pizza toppings.

Let's put this into perspective. Enough Senators have signed this letter that they could have drafted deficit-reducing legislation, voted on it, and passed it. It is enough Senators to defeat an anti-deficit-reducing filibuster. It is nearly enough Senators that, by the time the deficit-reducing bill arrived on the president's desk, it would have been veto-proof. It is actually just two Senators short of the number needed to impeach the president if he irritated them. It's really quite a lot of Senators.

So an adult might wonder why a filibuster-proof, almost veto-proof supermajority of elected officials trusted with the authority to pass laws is spending their time writing fan mail rather than, you know, actually doing something about the deficit. But then we would not be treated to the infinitely redeeming spectacle of sixty-four grown members of congress begging for an intervention like a hopeless crack addict. This is what makes America great.

The Senate, on the other hand, used to be the body we regularly trusted with passing laws. And sixty four (64!) Senators have signed this, in spite of the fact that you could not normally get more than eight to agree on pizza toppings.

Let's put this into perspective. Enough Senators have signed this letter that they could have drafted deficit-reducing legislation, voted on it, and passed it. It is enough Senators to defeat an anti-deficit-reducing filibuster. It is nearly enough Senators that, by the time the deficit-reducing bill arrived on the president's desk, it would have been veto-proof. It is actually just two Senators short of the number needed to impeach the president if he irritated them. It's really quite a lot of Senators.

So an adult might wonder why a filibuster-proof, almost veto-proof supermajority of elected officials trusted with the authority to pass laws is spending their time writing fan mail rather than, you know, actually doing something about the deficit. But then we would not be treated to the infinitely redeeming spectacle of sixty-four grown members of congress begging for an intervention like a hopeless crack addict. This is what makes America great.

Tuesday, March 1, 2011

The Bookstores! Won't Someone Please Think Of The Bookstores

We've nothing but respect for Ezra Klein, but this is odd.

Right. So we're pathologically lazy, and didn't really want to take the time to research the current size of the e-book market - not that anyone likes to disclosure their sales figures, anyway. A year-old Forrester research study will have to do. A quick and dirty look at their projections suggest around 5 million consumers. Fine.

Let's put that in perspective. How big is the book trade? Again, we turn to 2009 numbers of questionable veracity: 23.9 billion. E-books pulled in a respectable $313 million.

Hang on a tick. Just north of $300 million? Even if we postulated that the e-book market increased ten-fold in the intervening two years, they'd still comprise somewhere north of 10% of total sales1. That's big, but it's not THAT big.

It's also assuming a zero-sum situation - at least one of the studies we read suggested that owning an e-reader increased the number of books read, but didn't decrease paperback sales.

Curiouser and curiouser. We're no trained retailer, but it's possible a market the size of the e-book could destroy a company. It just seems unlikely. While we usually promise not to source the Wall Street Journal, we'll make the exception and direct you here. Their take, at least, is that problems facing Borders are a bit more traditional - $1.29 billion in liabilities and intense competition from online retailers. One assumes the recession didn't help.

Anyway. All of this is to say two things: There is no collapsing world of books. When a book moves to an e-reader, it doesn't disappear. It moves onto a new medium. That's a good thing!

And while book sales might be down, so are sales in everything else. Toyota had to be rescued by the Japanese government back in 2008. That doesn't mean we face the collapsing world of the car.

Border's bankruptcy wasn't driven by the e-book, although it probably didn't help. It was driven by a crap economy and a lot of debt, plus stiff competition from a very efficient online retailer. Eventually the e-reader will own the market - just not quite yet.

1Yes, this is an unedifying miscarriage of basic mathematics. We do not bother to dwell upon the expected market size or the commiserate decline in paper book sales. Forgive us.

Borders probably can't be saved. But what about Barnes and Noble? Over at GigaOm, Michael Wolf argues that they're going to need a radically different model if they're to survive: "In the collapsing world of books, it’s every man for himself, and its time for B&N to accelerate its push into becoming a digital publisher."

Right. So we're pathologically lazy, and didn't really want to take the time to research the current size of the e-book market - not that anyone likes to disclosure their sales figures, anyway. A year-old Forrester research study will have to do. A quick and dirty look at their projections suggest around 5 million consumers. Fine.

Let's put that in perspective. How big is the book trade? Again, we turn to 2009 numbers of questionable veracity: 23.9 billion. E-books pulled in a respectable $313 million.

Hang on a tick. Just north of $300 million? Even if we postulated that the e-book market increased ten-fold in the intervening two years, they'd still comprise somewhere north of 10% of total sales1. That's big, but it's not THAT big.

It's also assuming a zero-sum situation - at least one of the studies we read suggested that owning an e-reader increased the number of books read, but didn't decrease paperback sales.

Curiouser and curiouser. We're no trained retailer, but it's possible a market the size of the e-book could destroy a company. It just seems unlikely. While we usually promise not to source the Wall Street Journal, we'll make the exception and direct you here. Their take, at least, is that problems facing Borders are a bit more traditional - $1.29 billion in liabilities and intense competition from online retailers. One assumes the recession didn't help.

Anyway. All of this is to say two things: There is no collapsing world of books. When a book moves to an e-reader, it doesn't disappear. It moves onto a new medium. That's a good thing!

And while book sales might be down, so are sales in everything else. Toyota had to be rescued by the Japanese government back in 2008. That doesn't mean we face the collapsing world of the car.

Border's bankruptcy wasn't driven by the e-book, although it probably didn't help. It was driven by a crap economy and a lot of debt, plus stiff competition from a very efficient online retailer. Eventually the e-reader will own the market - just not quite yet.

1Yes, this is an unedifying miscarriage of basic mathematics. We do not bother to dwell upon the expected market size or the commiserate decline in paper book sales. Forgive us.

Thursday, February 24, 2011

Children Of The Revolution

If anyone in the Western hemisphere hasn’t weighed in on the events in Wisconsin, then it’s news to us. It’s a situation perfectly designed to excite both sides – conservatives have an opportunity to deliver a final blow in their long fight against the labor movement, while the unions, having contrived to lose most of their major battles in the last thirty years, see a chance to win a fight.

One interesting dialogue has emerged, with notables like Krugman and Drum on one side, and Avent to the other. In the first argument, unions represent the last meaningful political power that still fights for the middle class. America is already flirting with oligarchy, so it seems inopportune to surrender the field to vested business interests.

On the other hand, as Ryan Avent persuasively points out, unions haven’t been terribly good at mobilizing for the middle class any time recently. Wages have stagnated, jobs have disappeared, and union membership is falling. Much of this blame lies elsewhere. The mechanization of manufacturing brutalized many traditionally staunch union vocations. An increasingly globalized world was always going to decrease America’s relative share of the international economy.

Also, as others note, unions are not angels. They lead to cartelization and abuse. Often, they fight to deliver a larger share of a shrinking pie, rather than promoting policies that would lead to greater economic growth for all. They sometimes protect the employment of workers who are not fit for their positions.

Further, while cursory evidence strongly suggests no correlation between union membership and state budget deficits, and weak correlation between membership and per capita spending, state employees are an expense on the public purse. At a time when the largesse of the government is constrained, it is perfectly equitable that they should shoulder some share of the burden.

We’re big fans of Avent. We like the cut of his jib. But in this case, we disagree. Not, we’re afraid, for any terribly factual or rigorous reason. We’re just pissed.

To us, it seems that this recession has offered innumerable opportunities for the poor and the middle class to “shoulder their share” of the burden. The mortgage cramdown was defeated because it posed a threat to bank balance sheets and because renegotiating mortgages rewarded irresponsible borrowers. The Republicans suggest cutting social programs because we can not afford things like nutrition assistance or worker retraining – but tax cuts are probably ok. We can’t afford more stimulus, can’t countenance a rate of inflation that would erode nominal debts, and certainly aren’t about to let those dastardly public workers of the hook.

Yet we passed TARP. We repaired the balance sheets of the big banks. We recapitalized the financial sector. We made good on AIG’s collateralized obligations. We didn’t stand in the way of record bonuses on Wall Street. We didn’t pass clawback taxes on bonuses or a Tobin tax, or raise bank collateral independent of Basel III, or pass a strong Volcker rule. We allowed exemptions for derivatives trading on clearing houses and we didn’t touch the taxation of capital gains. The wizards of the financial world ran the economy over a cliff and in return, we did nothing.

And there was always a reason for it! Always a perfectly good reason. We’ve got to keep the economy humming, we have to make the financiers happy ensure a smoothly running economic machine. Only it’s not running very smoothly, not these days, not with growth below trend and inequality growing and revenues down and budget deficits on the rise. So now we take the axe to the public sector unions. Because someone has to help balance the books.

So when we defend the unions in Wisconsin, it’s partially because we’ve reasons to like the concept of organized labor as a countervailing political force. But also because, in a fit of pique, we want a line drawn in the sand. We want our fucking revolution. Because when it’s time to pay the pound of flesh, our betters always seem to have better things to do, but we’re given a knife and asked to start cutting. And that’s not right. That’s not right at all.

One interesting dialogue has emerged, with notables like Krugman and Drum on one side, and Avent to the other. In the first argument, unions represent the last meaningful political power that still fights for the middle class. America is already flirting with oligarchy, so it seems inopportune to surrender the field to vested business interests.

On the other hand, as Ryan Avent persuasively points out, unions haven’t been terribly good at mobilizing for the middle class any time recently. Wages have stagnated, jobs have disappeared, and union membership is falling. Much of this blame lies elsewhere. The mechanization of manufacturing brutalized many traditionally staunch union vocations. An increasingly globalized world was always going to decrease America’s relative share of the international economy.

Also, as others note, unions are not angels. They lead to cartelization and abuse. Often, they fight to deliver a larger share of a shrinking pie, rather than promoting policies that would lead to greater economic growth for all. They sometimes protect the employment of workers who are not fit for their positions.

Further, while cursory evidence strongly suggests no correlation between union membership and state budget deficits, and weak correlation between membership and per capita spending, state employees are an expense on the public purse. At a time when the largesse of the government is constrained, it is perfectly equitable that they should shoulder some share of the burden.

We’re big fans of Avent. We like the cut of his jib. But in this case, we disagree. Not, we’re afraid, for any terribly factual or rigorous reason. We’re just pissed.